The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, is centered around the theme of "Sabka Vikas" (Inclusive Growth) and the long-term vision of Viksit Bharat (Developed India) by 2047. With a focus on economic expansion, employment generation, and fiscal consolidation, this budget is being termed a “dream budget” for the middle class.

Key Themes & Objectives

Sabka Vikas—Balanced growth across all regions.

Viksit Bharat Goals – Zero poverty, quality education, affordable healthcare, skilled workforce, and women’s economic participation.

Key Focus Areas—Poor (Garib), Youth, Farmers (Annadata), and Women (Nari).

Four Growth Engines—Agriculture, MSMEs, Investment, and Exports.

Key Focus Areas & Growth Engines

The Budget revolves around four major economic engines:

Agriculture

MSMEs

Investment

Exports

Additionally, Reforms act as the fuel to drive these engines forward.

1st Engine: Agriculture

Launch of ‘Prime Minister Dhan-Dhaanya Krishi Yojana’ covering 100 districts.

‘Mission for Aatmanirbharta in Pulses’ (6 years) with procurement of Tur, Urad, and Masoor.

Kisan Credit Card (KCC) Loan Limit Increased from ₹3 lakh to ₹5 lakh.

Cotton Productivity Mission (5 years) and Comprehensive Programme for Fruits & Vegetables.

Impact on Agriculture Sector

Improved farm productivity and income.

Better storage, irrigation, and crop diversification.

Encouragement for small and marginal farmers.

2nd Engine: MSMEs

Investment & Turnover Limits for MSMEs Increased by 2.5 times & 2 times respectively.

Credit Enhancement: Increased guarantee cover for MSMEs.

New Scheme for 5 lakh Women, SC/ST Entrepreneurs (₹2 crore term loans in 5 years).

National Manufacturing Mission for “Make in India”.

Toy Industry Boost: Government to develop India as a global hub for toys.

Impact on MSMEs

Enhanced credit access and ease of doing business.

More women and marginalized communities in entrepreneurship.

Strengthened domestic manufacturing & exports.

3rd Engine: Investment

Investment in People

50,000 Atal Tinkering Labs in Government Schools.

Broadband in All Govt. Schools & Primary Health Centres (BharatNet).

National AI Centre of Excellence for Education (₹500 Cr).

Investment in Economy

₹1.5 Lakh Cr Interest-Free Loan to states for capital expenditure.

Asset Monetization Plan 2025-30 (₹10 Lakh Cr).

Jal Jeevan Mission Extended Till 2028.

₹1 Lakh Cr Urban Challenge Fund for “Cities as Growth Hubs”.

Investment in Innovation

₹20,000 Cr Fund for Private Sector R&D & Innovation.

Gyan Bharatam Mission: Survey & Digital Repository of 1 Crore Manuscripts.

National Geospatial Mission to improve urban planning.

Impact on Investment & Infrastructure

Boost to Digital & AI Education.

Higher capital investment for urban & rural infrastructure.

Strengthened research & innovation ecosystem.

4th Engine: Exports

Export Promotion Mission (focus on MSMEs & Global Supply Chains).

‘BharatTradeNet’ (BTN): Unified Digital Trade Documentation & Finance Platform.

Support for Domestic Manufacturing (Industry 4.0, Electronics, Warehousing).

Air Cargo & Horticulture Infrastructure Upgrades.

Impact on Exports

Strengthened India’s role in global trade & supply chains.

Easier export financing & digital trade solutions.

Growth in manufacturing, logistics & agri-exports.

Taxation & Financial Reforms

Zero Income Tax for Individuals Earning up to ₹12 Lakh under the new tax regime.

Section 87A rebate limit increased from ₹7 lakh to ₹12 lakh (Maximum rebate: ₹60,000).

Revenue Loss: ₹1 Lakh Crore due to tax reductions.

100% FDI Limit for Insurance (from 74%) (Only if entire premium is invested in India).

Investment Friendliness Index for States (2025).

Jan Vishwas Bill 2.0 (Decriminalization of 100+ Laws).

New Income Tax Slabs:

Other Tax Reforms

Senior Citizen TDS Limit on Interest Doubled (₹50,000 → ₹1 Lakh).

TDS on Rent Increased to ₹6 Lakh (from ₹2.4 Lakh).

4-Year Time Limit for Filing Updated Returns (Earlier: 2 Years).

Impact on Economy & Business

Easier business regulations & FDI growth.

Greater state competition for investments.

More efficient financial regulation for sustained economic growth.

Impact on Middle Class & Business

More disposable income → Increased Consumption & Savings.

Lower compliance burden for businesses & individuals.

Boost to real estate & investment in financial products.

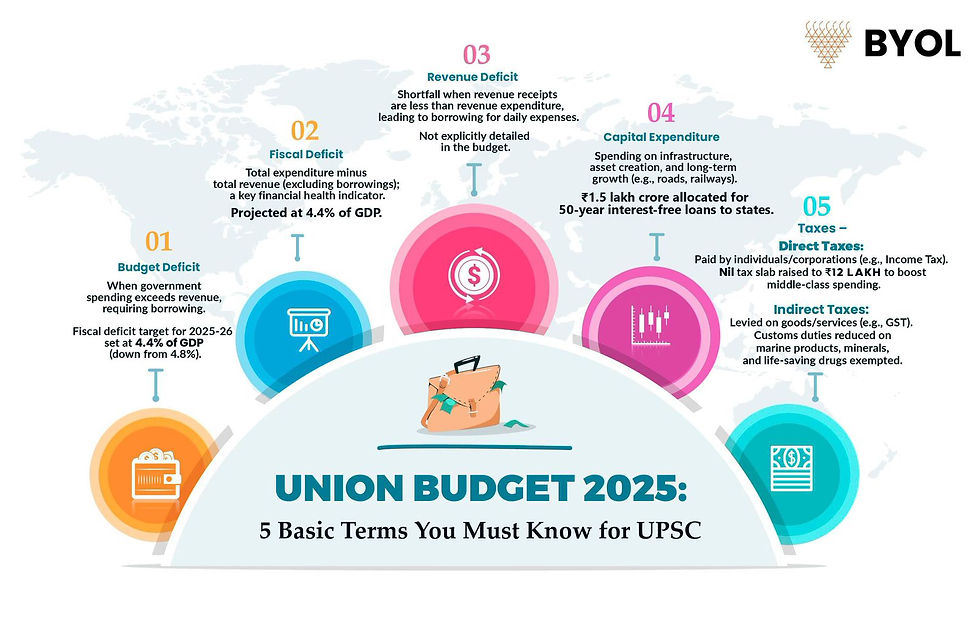

Capital Expenditure & Fiscal Deficit

Capital Expenditure (Capex) increased to ₹11.21 lakh crore (up from ₹11.11 lakh crore in FY2024-25).

Fiscal deficit pegged at 4.4% of GDP, down from 4.8% last year.

Market Borrowings estimated at ₹11.53 lakh crore, reduced from ₹14.01 lakh crore in FY2024-25.

Infrastructure & Economic Growth

Modified UDAN scheme to connect 120 new destinations, targeting 4 crore passengers in 10 years.

Real Estate Boost—Swamih Fund 2 launched with ₹15,000 crore for housing sector revival.

Manufacturing Push—Incentives for clean tech industries, EV batteries, solar PV cells, and wind turbines.

Tourism Promotion—Development of 50 top tourist sites, MUDRA loans for homestays, and e-visa expansion.

Import Duty Exemptions & Reductions

36 Life-Saving Cancer & Rare Disease Drugs → No Basic Customs Duty (BCD).

Critical Minerals (Cobalt, Lithium, Zinc) for Battery Manufacturing → BCD Exempted.

Textile Machinery & Shuttle-less Looms → BCD Exempted.

Incentives for “Make in India”

EV & Mobile Phone Battery Manufacturing: 35 Capital Goods Exempted.

Shipbuilding Components → BCD Exemption Extended for 10 Years.

Knitted Fabrics Tariff Increased (10% to 20% or ₹115/kg, whichever is higher).

Impact on Industry

Boost to healthcare affordability & pharma industry.

Strengthened EV & electronics manufacturing

Increased domestic textile & handicraft production.

Bihar-Focused Development

The Makhana Board announced it would improve production & marketing.

Greenfield airports are planned in Bihar to boost connectivity.

Employment & Industry Initiatives

22 lakh new jobs are to be generated, with a focus on the footwear & leather sector.

MSMEs, Startups, and Gig workers get special policy support.

The FDI limit in insurance increased from 74% to 100%.

Nuclear & Energy Investments

₹20,000 crore allocated for the Nuclear Energy Mission to develop 5 Small Modular Reactors (SMRs) by 2033.

Energy sector allocation increased by 18% YoY to ₹81,174 crore.

Defence & IT Sector Allocations

Defence Budget set at ₹4.91 lakh crore (up from ₹4.56 lakh crore).

IT & Telecom Allocation reduced to ₹95,298 crore from ₹1.16 lakh crore.

Relief for Consumers – Cheaper Goods

Reduced prices on:

Cancer & lifesaving drugs.

Solar PV cells & lithium-ion batteries.

Telecom & semiconductor equipment.

MSMEs & Startup Support

Credit Guarantee Cover increased from ₹5 crore to ₹10 crore.

New Entrepreneurs’ Scheme – ₹2 crore term loans for 5 lakh women and SC, ST entrepreneurs.

BharatTradeNet (BTN) – Digital trade documentation & financing for exporters.

Social Welfare & Policy Reforms

Tax Exemptions on 36 lifesaving drugs.

New Urea Plant in Assam—12.7 lakh metric tonne capacity.

22 Lakh Jobs Creation – Focus on the footwear & leather industry.

‘Mission for Aatmanirbharta in Pulses’ – Six-year plan for domestic production.

Additional Reforms & Governance

Self-Occupied Property Rule Removed—Taxpayers can claim two properties as self-occupied.

New Income Tax Bill to simplify tax laws by reducing tax by 50%.

A budget that supports middle-class savings, employment, and economic growth.

Overall Impact of Budget 2025-26

Middle Class: Higher savings, consumption boost.

Farmers: Higher credit, better procurement, rural employment.

MSMEs: Enhanced credit access, better global trade opportunities.

Startups & Entrepreneurs: Investment-friendly reforms, regulatory ease.

Investors & Businesses: Lower taxation, infrastructure push.

Infrastructure and Exports: Increased manufacturing & global trade integration.

A Transformative Budget for Growth & Stability

The Union Budget 2025-26 lays the foundation for a self-reliant and developed India by:

Providing tax relief to the middle class.

Boosting infrastructure & manufacturing.

Encouraging entrepreneurship & employment.

Strengthening agriculture & rural economies.

Maintaining fiscal discipline.

With a balanced approach of tax relief, economic expansion, and social welfare, this budget reflects the government’s vision for a prosperous, self-reliant India while ensuring sustainable growth and fiscal responsibility.

Time for even finance minister to read this article.

I have a question as well, would it be economical for me to enjoy Caramelised Popcorn 🍿 now.If yes ,I will send one for you as well.

India needs to enhance the EODB index to attract FDI. Also to achieve viksit bharat goal by 2047 the economic growth needs to be uplifted to 8%for atleast a decade.Well,it is great to hear the KCC being increased to whopping 5Lacs ,it is equally not good to make kisans habitual to resort to loans as it leads to a vicious debt cycle.Overall, the tax slab could have provided more relief to middle class. Thank you Ishrat Kashafi for such a wonderful write-up.was eagerly waiting for budget pe charchaa from you. More power to your pen.

The union budget for 2025-26 has been meticulously summarized and comprehensively addressed for diverse applications.

May Allah bestow blessings upon you and your platform, which has afforded the opportunity to showcase your talents and articulate your thoughts.