The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, is centered around the theme of “Sabka Vikas” (Inclusive Growth) and the long-term vision of Viksit Bharat (Developed India) by 2047. With a focus on economic expansion, employment generation, and fiscal consolidation, this budget is being termed a “dream budget” for the middle class.

Key Themes & Objectives

- Sabka Vikas—Balanced growth across all regions.

- Viksit Bharat Goals – Zero poverty, quality education, affordable healthcare, skilled workforce, and women’s economic participation.

- Key Focus Areas—Poor (Garib), Youth, Farmers (Annadata), and Women (Nari).

- Four Growth Engines—Agriculture, MSMEs, Investment, and Exports.

Key Focus Areas & Growth Engines

The Budget revolves around four major economic engines:

- Agriculture

- MSMEs

- Investment

- Exports

Additionally, Reforms act as the fuel to drive these engines forward.

1st Engine: Agriculture

- Launch of ‘Prime Minister Dhan-Dhaanya Krishi Yojana’ covering 100 districts.

- ‘Mission for Aatmanirbharta in Pulses’ (6 years) with procurement of Tur, Urad, and Masoor.

- Kisan Credit Card (KCC) Loan Limit Increased from ₹3 lakh to ₹5 lakh.

- Cotton Productivity Mission (5 years) and Comprehensive Programme for Fruits & Vegetables.

Impact on Agriculture Sector

- Improved farm productivity and income.

- Better storage, irrigation, and crop diversification.

- Encouragement for small and marginal farmers.

2nd Engine: MSMEs

- Investment & Turnover Limits for MSMEs Increased by 2.5 times & 2 times respectively.

- Credit Enhancement: Increased guarantee cover for MSMEs.

- New Scheme for 5 lakh Women, SC/ST Entrepreneurs (₹2 crore term loans in 5 years).

- National Manufacturing Mission for “Make in India”.

- Toy Industry Boost: Government to develop India as a global hub for toys.

Impact on MSMEs

- Enhanced credit access and ease of doing business.

- More women and marginalized communities in entrepreneurship.

- Strengthened domestic manufacturing & exports.

3rd Engine: Investment

Investment in People

- 50,000 Atal Tinkering Labs in Government Schools.

- Broadband in All Govt. Schools & Primary Health Centres (BharatNet).

- National AI Centre of Excellence for Education (₹500 Cr).

Investment in Economy

- ₹1.5 Lakh Cr Interest-Free Loan to states for capital expenditure.

- Asset Monetization Plan 2025-30 (₹10 Lakh Cr).

- Jal Jeevan Mission Extended Till 2028.

- ₹1 Lakh Cr Urban Challenge Fund for “Cities as Growth Hubs”.

Investment in Innovation

- ₹20,000 Cr Fund for Private Sector R&D & Innovation.

- Gyan Bharatam Mission: Survey & Digital Repository of 1 Crore Manuscripts.

- National Geospatial Mission to improve urban planning.

Impact on Investment & Infrastructure

- Boost to Digital & AI Education.

- Higher capital investment for urban & rural infrastructure.

- Strengthened research & innovation ecosystem.

4th Engine: Exports

- Export Promotion Mission (focus on MSMEs & Global Supply Chains).

- ‘BharatTradeNet’ (BTN): Unified Digital Trade Documentation & Finance Platform.

- Support for Domestic Manufacturing (Industry 4.0, Electronics, Warehousing).

- Air Cargo & Horticulture Infrastructure Upgrades.

Impact on Exports

- Strengthened India’s role in global trade & supply chains.

- Easier export financing & digital trade solutions.

- Growth in manufacturing, logistics & agri-exports.

Taxation & Financial Reforms

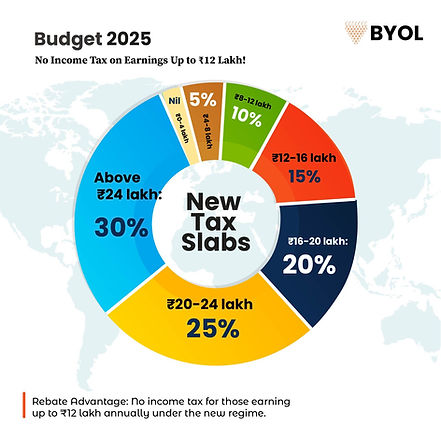

- Zero Income Tax for Individuals Earning up to ₹12 Lakh under the new tax regime.

- Section 87A rebate limit increased from ₹7 lakh to ₹12 lakh (Maximum rebate: ₹60,000).

- Revenue Loss: ₹1 Lakh Crore due to tax reductions.

- 100% FDI Limit for Insurance (from 74%) (Only if entire premium is invested in India).

- Investment Friendliness Index for States (2025).

- Jan Vishwas Bill 2.0 (Decriminalization of 100+ Laws).

New Income Tax Slabs:

Other Tax Reforms

- Senior Citizen TDS Limit on Interest Doubled (₹50,000 → ₹1 Lakh).

- TDS on Rent Increased to ₹6 Lakh (from ₹2.4 Lakh).

- 4-Year Time Limit for Filing Updated Returns (Earlier: 2 Years).

Impact on Economy & Business

- Easier business regulations & FDI growth.

- Greater state competition for investments.

- More efficient financial regulation for sustained economic growth.

Impact on Middle Class & Business

- More disposable income → Increased Consumption & Savings.

- Lower compliance burden for businesses & individuals.

- Boost to real estate & investment in financial products.

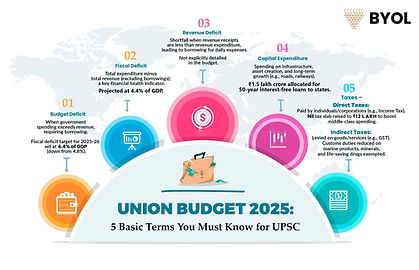

Capital Expenditure & Fiscal Deficit

- Capital Expenditure (Capex) increased to ₹11.21 lakh crore (up from ₹11.11 lakh crore in FY2024-25).

- Fiscal deficit pegged at 4.4% of GDP, down from 4.8% last year.

- Market Borrowings estimated at ₹11.53 lakh crore, reduced from ₹14.01 lakh crore in FY2024-25.

Infrastructure & Economic Growth

- Modified UDAN scheme to connect 120 new destinations, targeting 4 crore passengers in 10 years.

- Real Estate Boost—Swamih Fund 2 launched with ₹15,000 crore for housing sector revival.

- Manufacturing Push—Incentives for clean tech industries, EV batteries, solar PV cells, and wind turbines.

- Tourism Promotion—Development of 50 top tourist sites, MUDRA loans for homestays, and e-visa expansion.

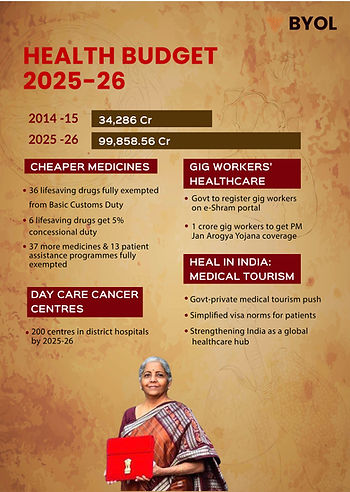

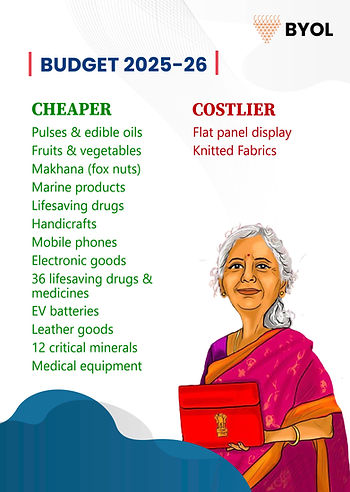

Import Duty Exemptions & Reductions

- 36 Life-Saving Cancer & Rare Disease Drugs → No Basic Customs Duty (BCD).

- Critical Minerals (Cobalt, Lithium, Zinc) for Battery Manufacturing → BCD Exempted.

- Textile Machinery & Shuttle-less Looms → BCD Exempted.

Incentives for “Make in India”

- EV & Mobile Phone Battery Manufacturing: 35 Capital Goods Exempted.

- Shipbuilding Components → BCD Exemption Extended for 10 Years.

- Knitted Fabrics Tariff Increased (10% to 20% or ₹115/kg, whichever is higher).

Impact on Industry

Boost to healthcare affordability & pharma industry.

Strengthened EV & electronics manufacturing

Increased domestic textile & handicraft production.

Bihar-Focused Development

- The Makhana Board announced it would improve production & marketing.

- Greenfield airports are planned in Bihar to boost connectivity.

Employment & Industry Initiatives

- 22 lakh new jobs are to be generated, with a focus on the footwear & leather sector.

- MSMEs, Startups, and Gig workers get special policy support.

- The FDI limit in insurance increased from 74% to 100%.

Nuclear & Energy Investments

- ₹20,000 crore allocated for the Nuclear Energy Mission to develop 5 Small Modular Reactors (SMRs) by 2033.

- Energy sector allocation increased by 18% YoY to ₹81,174 crore.

Defence & IT Sector Allocations

- Defence Budget set at ₹4.91 lakh crore (up from ₹4.56 lakh crore).

- IT & Telecom Allocation reduced to ₹95,298 crore from ₹1.16 lakh crore.

Relief for Consumers – Cheaper Goods

- Reduced prices on:

- Cancer & lifesaving drugs.

- Solar PV cells & lithium-ion batteries.

- Telecom & semiconductor equipment.

MSMEs & Startup Support

- Credit Guarantee Cover increased from ₹5 crore to ₹10 crore.

- New Entrepreneurs’ Scheme – ₹2 crore term loans for 5 lakh women and SC, ST entrepreneurs.

- BharatTradeNet (BTN) – Digital trade documentation & financing for exporters.

Social Welfare & Policy Reforms

- Tax Exemptions on 36 lifesaving drugs.

- New Urea Plant in Assam—12.7 lakh metric tonne capacity.

- 22 Lakh Jobs Creation – Focus on the footwear & leather industry.

- ‘Mission for Aatmanirbharta in Pulses’ – Six-year plan for domestic production.

Additional Reforms & Governance

- Self-Occupied Property Rule Removed—Taxpayers can claim two properties as self-occupied.

- New Income Tax Bill to simplify tax laws by reducing tax by 50%.

A budget that supports middle-class savings, employment, and economic growth.

Overall Impact of Budget 2025-26

- Middle Class: Higher savings, consumption boost.

- Farmers: Higher credit, better procurement, rural employment.

- MSMEs: Enhanced credit access, better global trade opportunities.

- Startups & Entrepreneurs: Investment-friendly reforms, regulatory ease.

- Investors & Businesses: Lower taxation, infrastructure push.

- Infrastructure and Exports: Increased manufacturing & global trade integration.

A Transformative Budget for Growth & Stability

The Union Budget 2025-26 lays the foundation for a self-reliant and developed India by:

- Providing tax relief to the middle class.

- Boosting infrastructure & manufacturing.

- Encouraging entrepreneurship & employment.

- Strengthening agriculture & rural economies.

- Maintaining fiscal discipline.

With a balanced approach of tax relief, economic expansion, and social welfare, this budget reflects the government’s vision for a prosperous, self-reliant India while ensuring sustainable growth and fiscal responsibility.