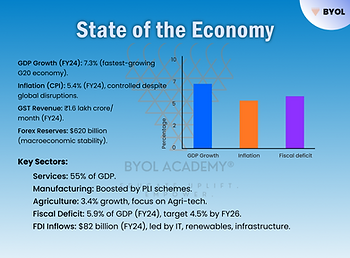

Chapter 1: State of the Economy

Current Context (2025)

- India’s GDP growth for FY24 is projected at 7.3%, making it one of the fastest-growing major economies.

- Inflation under control at 5.4% (CPI-based) despite global supply chain disruptions.

- Robust tax collections with GST revenue averaging ₹1.6 lakh crore/month in FY24.

- Forex reserves at $620 billion, ensuring macroeconomic stability.

India’s Economic Performance

- GDP Growth: Strong domestic consumption and investment are key drivers.

- Manufacturing and Services: Service sector contributed 55% to GDP, while PLI (Production-Linked Incentive) schemes boosted manufacturing.

- Agriculture: Growth rate moderated to 3.4%, with focus on digitalization and Agri-tech adoption.

Key Fiscal & Monetary Indicators

- Fiscal Deficit Target: 5.9% of GDP for FY24, aiming to reduce it to 4.5% by FY26.

- Current Account Deficit (CAD): Improved to 1.3% of GDP due to strong service exports.

- FDI Inflows: Total FDI in FY24 at $82 billion, led by IT, renewable energy, and infrastructure.

Sectoral Growth Trends

- Industry: Grew by 4.9%, supported by Make in India, PLI schemes, and infrastructure spending.

- Services: Expanded by 8.2%, driven by IT, digital services, and tourism recovery.

- Exports: Merchandise exports at $450 billion, while services exports touched $330 billion.

Employment & Social Sector Trends

- Unemployment Rate: Reduced to 6.2%, with highest job creation in MSMEs & startups.

- Digital Economy Growth: UPI transactions crossed ₹17 lakh crore per month, aiding financial inclusion.

Global Economic Comparisons

- India remains the fastest-growing G20 economy, ahead of China (4.8%) and the US (2.5%).

- World Bank projects India’s economy to reach $5 trillion by FY27.

Key Takeaways for UPSC Prelims

- India’s GDP Growth (FY24): 7.3%

- Forex Reserves: $620 billion

- Fiscal Deficit Target: 5.9% of GDP

- Current Account Deficit: 1.3% of GDP

- FDI Inflows: $82 billion

- UPI Transactions: ₹17 lakh crore/month

- Fastest Growing G20 Economy

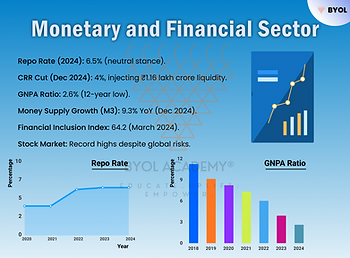

Chapter 2: Monetary and Financial Sector Developments

Current Context (2025)

- RBI maintained the repo rate at 6.5% throughout 2024, shifting from “withdrawal of accommodation” to a “neutral” stance in October.

- Inflation under control with the CRR cut to 4% in December 2024, injecting ₹1.16 lakh crore into the banking system.

- Banking sector strengthened, with the GNPA ratio declining to 2.6% (12-year low) and a rise in the Capital-to-Risk Weighted Asset Ratio (CRAR).

- Stock markets reached record highs, outperforming emerging market peers despite geopolitical risks.

Monetary Policy & Liquidity Trends

- RBI aims to balance inflation control and economic growth through instruments like repo rate, CRR, and SLR adjustments.

- Money supply (M3) grew by 9.3% YoY as of December 2024, with deposits as the largest contributor.

- Money Multiplier (MM) increased to 5.7, indicating higher liquidity circulation.

Banking & Credit Sector Performance

- Bank credit growth converging with deposit growth, ensuring financial stability.

- Decline in NPAs: GNPA of Scheduled Commercial Banks (SCBs) fell to 2.6%, while net NPAs stood at 0.6%.

- Rural Financial Institutions (RFIs) & Development Financial Institutions (DFIs) played a key role in economic inclusion and infrastructure funding.

Capital Markets & Financial Inclusion

- Indian stock market hit new highs in December 2024, driven by domestic investment and foreign inflows.

- Financial Inclusion Index (RBI) improved to 64.2 (March 2024) from 53.9 in 2021, showing stronger banking penetration.

Emerging Trends & Risks

- Rise in consumer credit: Share in total bank credit increased from 18.3% in FY14 to 32.4% in FY24.

- Growth in non-bank financing: Banks’ share in total credit fell from 77% (FY11) to 58% (FY22), with NBFCs and bond markets expanding.

- Increase in equity financing: IPO listings grew six times between FY13 and FY24, making India the top IPO market globally.

Key Takeaways for UPSC Prelims

- Repo Rate (2024): 6.5%

- Cash Reserve Ratio (CRR): Cut to 4% (Dec 2024)

- GNPA Ratio (Sept 2024): 2.6% (12-year low)

- Money Supply (M3) Growth: 9.3% YoY (Dec 2024)

- Financial Inclusion Index: 64.2 (March 2024)

- Stock Market: Record highs despite global uncertainties

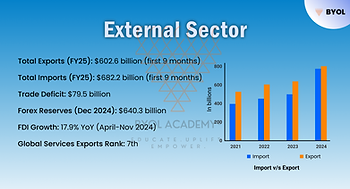

Chapter 3: External Sector

Current Context (2025)

- India’s total exports (merchandise + services) reached $602.6 billion in the first nine months of FY25, growing at 6% YoY.

- Imports increased by 6.9% to $682.2 billion, driven by strong domestic demand.

- FDI inflows revived, but net FDI declined due to increased repatriation.

- Foreign exchange reserves at $640.3 billion (Dec 2024), covering 90% of external debt ($711.8 billion, Sept 2024).

India’s Trade Performance

- Service sector exports grew by 10.4%, while non-petroleum, non-gems exports expanded by 9.1%.

- The trade deficit widened to $79.5 billion, driven by higher import demand.

- India ranked 7th in global services exports, highlighting competitiveness in IT, finance, and consulting.

Foreign Direct Investment (FDI) Trends

- Gross FDI inflows increased by 17.9% YoY (April-Nov 2024).

- Net FDI fell due to high repatriation, which rose 33.2% YoY, reflecting strong investor profit-booking.

- Sectors attracting FDI: Services (19.1%), Software & Hardware (14.1%), Renewable Energy (7%), Trading (9.1%).

Foreign Portfolio Investment (FPI) & Forex Reserves

- FPI inflows are volatile due to global uncertainties, but positive overall.

- Forex reserves peaked at $704.9 billion (Sept 2024), later moderating to $634.6 billion (Jan 2025).

- India’s sovereign bonds included in JP Morgan EM Bond Index, attracting foreign debt investors.

Global Trade Challenges & India’s Strategy

- Geopolitical risks, protectionism, and trade policy changes impacting exports.

- India diversifying export markets, increasing focus on biotechnology, semiconductors, and high-value manufacturing.

Key Takeaways for UPSC Prelims

- Total Exports (FY25 first 9 months): $602.6 billion

- Total Imports (FY25 first 9 months): $682.2 billion

- Trade Deficit: $79.5 billion

- Forex Reserves (Dec 2024): $640.3 billion

- Gross FDI Growth: 17.9% YoY

- India’s Global Ranking in Services Exports: 7th

India’s external sector remains resilient, with export growth, strong forex reserves, and stable capital inflows, despite global economic challenges.

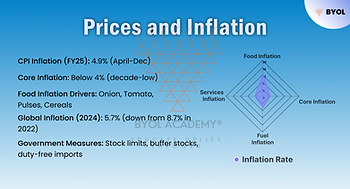

Chapter 4: Prices and Inflation

Current Context (2025)

- Retail inflation in India moderated from 5.4% in FY24 to 4.9% in FY25 (April-December) due to government interventions and monetary policy adjustments.

- Core inflation (excluding food and fuel) reached a decade-low, while food inflation remained volatile due to supply chain disruptions and extreme weather.

- Global inflation declined from 8.7% (2022) to 5.7% (2024), helped by tight monetary policies.

Global Inflation Trends

- Monetary tightening by central banks worldwide led to a gradual decline in global inflation.

- Despite high interest rates, global economic resilience helped stabilize inflation rates.

- Commodity prices softened due to improved global supply chains, though geopolitical risks remain.

Domestic Inflation Trends

- Consumer Price Index (CPI) inflation decreased to 4.9% (FY25 April-December).

- Food inflation remained high, driven by vegetables (especially onion & tomato), pulses, and cereals.

- Core inflation fell below 4%, mainly due to stable fuel and service prices.

Government Measures to Control Inflation

- Stock limits imposed on wheat and pulses to prevent hoarding.

- Buffer stock operations for onions and tomatoes under the Price Stabilization Fund.

- Subsidized sale of essential food items (e.g., onions at ₹35/kg, tomatoes at ₹65/kg).

- Duty-free imports of pulses (tur, urad, masur) till March 2025.

Key Risks & Challenges

- Extreme weather events (heatwaves, cyclones, unseasonal rains) are impacting food prices.

- Geopolitical uncertainties affecting global oil and food prices.

- Supply chain disruptions leading to price volatility in essential commodities.

Key Takeaways for UPSC Prelims

- India’s CPI Inflation (FY25 April-Dec): 4.9%

- Core Inflation: Below 4% (lowest in a decade)

- Global Inflation (2024): 5.7% (down from 8.7% in 2022)

- Major drivers of food inflation: Onion, Tomato, Pulses, Cereals

- Government measures: Stock limits, buffer stock, duty-free imports

India’s inflation outlook remains stable, with effective policy interventions helping to control price rise, though climate-related risks and global factors continue to pose challenges.

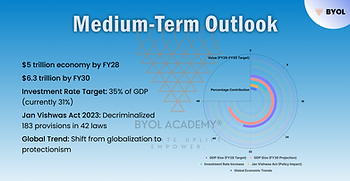

Chapter 5: Medium-Term Outlook

Current Context (2025)

- IMF projects India to become a $5 trillion economy by FY28 and $6.3 trillion by FY30.

- India needs 8% real GDP growth for the next two decades to achieve its Viksit Bharat@2047 goal.

- Global geo-economic fragmentation is reshaping trade and investment flows, requiring India to focus on domestic growth levers.

Global Economic Challenges & India’s Growth Path

- Geo-economic fragmentation: Shift from globalization to protectionism is affecting trade.

- China’s dominance: Challenges in supply chains, mineral resources, and energy transition impact India’s manufacturing sector.

- Climate transition costs: India must balance green growth with economic expansion.

India’s Growth Strategy

- Investment rate needs to increase to 35% of GDP from the current 31% to sustain high growth.

- Efficiency in investment is key: Faster implementation and higher output per investment are necessary.

- Boosting domestic demand & productivity to reduce dependence on exports.

Deregulation as a Catalyst for Growth

- Reducing compliance burden for businesses, especially MSMEs, to enhance entrepreneurship.

- Jan Vishwas Act 2023 decriminalized 183 provisions across 42 central laws, easing business operations.

- State-led reforms: Punjab, Tamil Nadu, and Andhra Pradesh simplified labor and industrial regulations.

- Sectoral deregulation: Land, labor, logistics, and environmental laws being reformed.

Key Policy Recommendations

- Ease of Doing Business (EoDB) 2.0: State-led initiative to simplify business regulations.

- Tax and tariff rationalization: Reducing industrial electricity costs to boost competitiveness.

- Adopting global best practices: Learning from US, UK, and Germany in deregulation policies.

Key Takeaways for UPSC Prelims

- IMF GDP Projections: $5 trillion by FY28, $6.3 trillion by FY30.

- Investment Rate Target: 35% of GDP (currently 31%).

- Jan Vishwas Act 2023: Decriminalized 183 provisions in 42 laws.

- States Leading in Deregulation: Punjab, Tamil Nadu, Andhra Pradesh.

- Global Economic Trend: Shift from globalization to protectionism.

India’s focus on deregulation, domestic growth levers, and investment efficiency will be crucial to sustain its economic momentum amid global uncertainties.

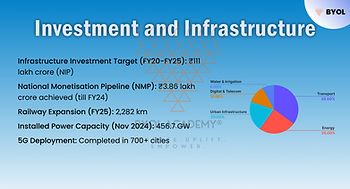

Chapter 6: Investment and Infrastructure

Current Context (2025)

- Capital expenditure on infrastructure increased post-election, with ₹1.91 lakh crore targeted for FY25.

- Private participation in infrastructure projects remains a challenge, despite the government’s push for Public-Private Partnerships (PPP).

- Sustainable construction practices and digital infrastructure development are gaining prominence.

India’s Infrastructure Investment Trends

- Government capital expenditure (Capex) on infrastructure grew at 38.8% CAGR from FY20 to FY24.

- National Infrastructure Pipeline (NIP) aims for ₹111 lakh crore investment from FY20 to FY25, covering 9,766 projects across 37 sub-sectors.

- National Monetisation Pipeline (NMP): Target of ₹6 lakh crore (FY22-FY25), with ₹3.86 lakh crore achieved by FY24.

- Major sectors: Roads, power, civil aviation, telecom, railways, ports.

Physical & Digital Connectivity Developments

- Railways: 17 new Vande Bharat trains launched; 2,282 km of railway network commissioned.

- Roads & Highways: Expansion of Bharatmala Pariyojana and expressways.

- Digital Infrastructure: 5G rollout completed in 700+ cities, rural broadband expansion via BharatNet.

Private Sector Participation & Financing Models

- PPP models in infrastructure: Build-Operate-Transfer (BOT), Hybrid Annuity Model (HAM), and Toll-Operate-Transfer (TOT).

- Challenges: High capital costs, long gestation periods, contract management issues.

- Solutions: Improved risk-sharing mechanisms, regulatory reforms, faster clearances.

Sector-Specific Infrastructure Growth

- Power Sector: Installed capacity at 456.7 GW (Nov 2024); expansion in renewable energy, smart grids.

- Urban Infrastructure: Swachh Bharat 2.0, Smart Cities Mission, AMRUT 2.0 driving urban transformation.

- Tourism Infrastructure: PRASHAD, Swadesh Darshan 2.0, focus on heritage and spiritual tourism.

- Space Infrastructure: ISRO’s Gaganyaan, Venus Orbiter, Bhartiya Antariksh Station projects approved.

Key Takeaways for UPSC Prelims

- Total Infrastructure Investment Target (FY20-FY25): ₹111 lakh crore (NIP).

- National Monetisation Pipeline (NMP) Achievement: ₹3.86 lakh crore (till FY24).

- Railway Network Expansion (FY25): 2,282 km.

- Installed Power Capacity (Nov 2024): 456.7 GW.

- 5G Deployment: Completed in 700+ cities.

India’s investment-driven growth strategy, focus on PPP in infrastructure, and sustainable construction practices are key to achieving Viksit Bharat@2047.

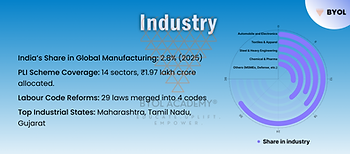

Chapter 7: Industry

Current Context (2025)

- India’s share in global manufacturing increased to 2.8%, but it remains far behind China’s 28.8%.

- Industrial growth slowed in H1 FY25, impacted by global trade disruptions and aggressive trade policies by major economies.

- PLI (Production Linked Incentive) scheme expanded to new sectors like semiconductors, textiles, and green hydrogen to boost domestic manufacturing.

India’s Manufacturing Performance

- Core industries (steel, cement, chemicals, petrochemicals) stabilized growth, while consumer sectors like automobiles, electronics, and pharmaceuticals drove expansion.

- The manufacturing sector’s share in India’s GDP is 17.4%, with efforts to reach 25% under Make in India.

Key Industrial Policies & Reforms

- Production Linked Incentive (PLI) Scheme: ₹1.97 lakh crore allocated across 14 key sectors.

- Ease of Doing Business (EoDB) 2.0: Focus on reducing compliance burden and digitization of business processes.

- Labour Code Reforms: Integration of 29 labour laws into 4 simplified codes to improve workforce flexibility.

- National Single Window System (NSWS): Streamlining business approvals with over 27,000 approvals granted.

State-Level Industrial Performance

- Maharashtra, Tamil Nadu, and Gujarat lead in industrial output and investment.

- States with reform potential: Bihar, Jharkhand, Madhya Pradesh, Uttar Pradesh need better industrial policies.

- Deregulation initiatives in states: Punjab and Tamil Nadu amended industrial policies to boost investments.

Global Challenges & Opportunities

- Geopolitical tensions and supply chain disruptions impacting export-driven manufacturing.

- India’s participation in global value chains (GVCs) improving, especially in electronics and electric vehicles.

Key Takeaways for UPSC Prelims

- India’s share in global manufacturing (2025): 2.8%.

- PLI Scheme coverage: 14 sectors.

- Labour Code Reforms: Merged 29 laws into 4 codes.

- Top industrial states: Maharashtra, Tamil Nadu, Gujarat.

- Ease of Doing Business 2.0 launched for compliance reduction.

India’s manufacturing sector is expanding but faces global trade uncertainties, making industrial reforms and deregulation critical for long-term growth.

Chapter 8: Services – New Challenges for the Old War Horse

Current Context (2025)

- The service sector remains the largest contributor to India’s GDP (57% in FY25), supporting GDP growth despite a global trade slowdown.

- India’s share in global services exports increased to 4.3% in 2024, ranking 7th globally, driven by IT, finance, and professional services.

- Logistics and digital services gained momentum, with Open Network for Digital Commerce (ONDC) expanding e-commerce inclusivity.

Services Sector Performance

- Services PMI at 53.8 (Dec 2024): Indicates steady expansion for 23 consecutive months.

- Bank credit to services sector stood at ₹48.5 lakh crore (Nov 2024), growing 13% YoY.

- FDI in services reached $5.7 billion in Apr-Sep FY25, with insurance and financial services leading inflows.

Key Growth Drivers

- “Servicification” of industries: Manufacturing increasingly integrates logistics, AI-driven business processes, and digital finance.

- India’s digital economy is expanding, with strong growth in cloud computing, AI, and fintech services.

- Government support for business process outsourcing (BPO) and IT-enabled services.

Challenges & Emerging Risks

- Global uncertainties impacting offshore IT services due to protectionist policies.

- Higher wage growth in the services sector causing persistent inflation.

- Need for skilled workforce as AI adoption reshapes service jobs.

Government Initiatives

- ONDC (Open Network for Digital Commerce): Expanding access to digital marketplaces.

- PLI Scheme for Services: Encouraging domestic value addition in sectors like telecom, fintech, and AI-driven automation.

- Skilling and Digital India Programs: Focus on AI, cloud computing, and cybersecurity workforce training.

Key Takeaways for UPSC Prelims

- Service sector contributes 57% to India’s GDP (FY25).

- India’s share in global services exports: 4.3% (7th rank).

- Bank credit to services: ₹48.5 lakh crore (Nov 2024), 13% YoY growth.

- ONDC boosting digital commerce & financial inclusion.

- Global protectionism & AI adoption reshaping service sector jobs.

India’s service sector remains resilient, driving economic growth, exports, and employment, but skilling, AI adoption, and global trade policies pose challenges.

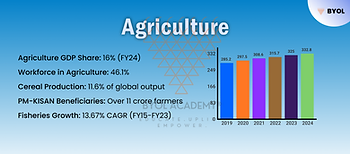

Chapter 9: Agriculture and Food Management – Sector of the Future

Current Context (2025)

- Agriculture sector growth rebounded to 3.5% in Q2 FY25, after fluctuating between 0.4% and 2.0% in the previous four quarters.

- India remains the world’s largest producer of cereals (11.6% of global output), but crop yields remain below the global average.

- Government expanding digital agriculture, irrigation infrastructure, and food processing industries to boost farm incomes.

Agriculture’s Contribution to the Economy

- Accounts for 16% of GDP (FY24, PE) and employs 46.1% of the workforce.

- Average sector growth: 5% annually (FY17-FY23), showcasing resilience despite climate challenges.

- Horticulture, livestock, and fisheries driving sectoral diversification, with fisheries growing at a CAGR of 13.67% (FY15-FY23).

Key Government Initiatives

- PM-KISAN: Direct income support to over 11 crore farmers.

- National Innovations in Climate Resilient Agriculture (NICRA): Promotes heat-resistant and high-yield crop varieties.

- e-NAM: Expanding agricultural marketing for better price discovery.

- Per Drop More Crop (PDMC): Expanding micro-irrigation coverage.

Sectoral Challenges & Opportunities

- Climate change impacts: Increasing frequency of dry spells and extreme rainfall.

- Low productivity: India’s crop yields remain 20-30% lower than the global average.

- Agricultural diversification: Shifting towards high-value crops, floriculture, and food processing industries.

- Storage & food security: Expansion of modern grain storage under the Public Distribution System (PDS), including smart warehouses and mobile storage units.

Key Takeaways for UPSC Prelims

- Agriculture GDP Share: 16% (FY24, PE).

- Workforce in Agriculture: 46.1%.

- Sector Growth (FY17-FY23): 5% annually.

- Largest producer of cereals: 11.6% of global output.

- Fastest growing allied sector: Fisheries (CAGR 13.67%).

- PM-KISAN beneficiaries: Over 11 crore farmers.

- e-NAM expanding agricultural market access.

India’s agriculture sector remains resilient, with policy support for diversification, climate adaptation, and market reforms, but productivity improvements and climate risk management remain key priorities.

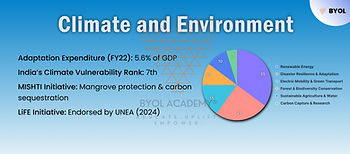

Chapter 10: Climate and Environment – Adaptation Matters

Current Context (2025)

- India ranks 7th among the most climate-vulnerable countries, facing extreme weather events, sea-level rise, and biodiversity loss.

- Adaptation expenditure increased from 3.7% to 5.6% of GDP (FY16-FY22), indicating growing climate resilience efforts.

- COP29 (Baku, 2024) failed to secure substantial climate finance commitments, with developed nations falling short of their NDC pledges by 38%.

India’s Adaptation Strategies

- National Adaptation Plan (NAP) under development, aligning with Sustainable Development Goals (SDGs).

- Agricultural adaptation: Climate-resilient seeds, groundwater conservation, improved soil health.

- Urban climate resilience: National Mission on Sustainable Habitat (NMSH) focuses on waste management, urban flooding, and green building initiatives.

- Coastal adaptation: Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) launched to protect coastlines and enhance carbon sequestration.

Energy Transition & Climate Challenges

- Renewable energy expansion faces storage and mineral access challenges.

- Global shift to net-zero emissions requires significant financial and technological support, which remains inadequate.

- LiFE (Lifestyle for Environment) initiative endorsed by UNEA (2024), promoting sustainable consumption and circular economy practices.

Key Takeaways for UPSC Prelims

- India’s Adaptation Expenditure (FY22): 5.6% of GDP.

- India’s Global Climate Vulnerability Rank: 7th.

- MISHTI Initiative: Mangrove protection & carbon sequestration.

- LiFE Initiative: Endorsed by UNEA (2024).

- COP29 Outcome: Developed nations missed NDC pledges by 38%.

India’s climate adaptation and mitigation strategy focuses on resilience-building, energy transition, and international cooperation, but funding gaps and technological barriers remain key challenges.

Chapter 11: Social Sector – Extending Reach and Driving Empowerment

Current Context (2025)

- India’s social sector expenditure increased to 26.2% of total government spending in FY25.

- NEP 2020 implementation expanded, focusing on foundational literacy, skill development, and digital education.

- Ayushman Bharat coverage expanded to 60 crore beneficiaries, strengthening India’s healthcare accessibility.

Education & Skill Development

- Gross Enrolment Ratio (GER): Near universal enrolment at the primary level (93%), with efforts underway to improve secondary (77.4%) and higher secondary (56.2%) levels.

- National Education Policy (NEP) 2020: Focuses on digital learning, vocational training, and reducing dropout rates.

- Digital education initiatives: Expansion of DIKSHA platform and PM e-Vidya for blended learning.

Healthcare & Social Welfare

- Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (PMJAY): Expanded coverage to 60 crore beneficiaries, reducing out-of-pocket expenditure.

- National Digital Health Mission (NDHM): Integrated with e-Sanjeevani telemedicine platform, providing 2.8 crore teleconsultations in FY24.

- Jan Aushadhi Kendras (JAKs): Over 14,000 outlets, ensuring affordable generic medicines availability.

Rural Development & Social Inclusion

- PM Awas Yojana (PMAY): Over 3.5 crore rural houses constructed, enhancing housing security.

- Jal Jeevan Mission: Achieved 75% rural household tap water coverage.

- Self Help Groups (SHGs): Over 87 lakh women-led SHGs supported under DAY-NRLM, strengthening livelihood generation.

Key Takeaways for UPSC Prelims

- Social sector expenditure: 26.2% of total government spending.

- GER (Primary): 93%; GER (Secondary): 77.4%.

- Ayushman Bharat covers 60 crore beneficiaries.

- Jal Jeevan Mission: 75% rural households have tap water.

- Self Help Groups (SHGs): 87 lakh women-led SHGs supported.

India’s social sector progress is driven by inclusive policies in education, healthcare, and rural development, but further improvements in governance and last-mile service delivery are essential.

Chapter 12: Employment and Skill Development – Existential Priorities

Current Context (2025)

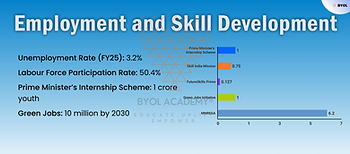

- India’s unemployment rate dropped to 3.2% in FY25, down from 6% in FY18, indicating a strong post-pandemic recovery.

- Labour Force Participation Rate (LFPR) increased to 50.4%, with urban unemployment declining to 6.4%.

- Formal job creation strengthened, with EPFO net payroll additions increasing significantly in FY24.

State of Employment in India

- Agriculture employs 44.8% of the workforce, though a gradual shift towards non-farm jobs is observed.

- Manufacturing sector employment rose, reflecting post-pandemic resilience.

- Service sector leads in formal job creation, contributing to 50% of new payroll additions.

Key Government Initiatives for Employment & Skilling

- Prime Minister’s Internship Scheme (PMIS): Internship in 500 top companies for 1 crore youth over five years.

- PMKVY 4.0: Skilling 20 lakh youth over five years, focusing on Industry 4.0, AI, and fintech.

- EPFO Employment Incentive Scheme: ₹3,000/month reimbursement for employers hiring additional workers.

- Skill India Digital Hub (SIDH): Expanding online skilling courses for AI, cybersecurity, and robotics.

Emerging Trends & Future Job Markets

- Rise of digital and AI-based jobs: 1.27 lakh professionals trained under FutureSkills Prime.

- Women’s workforce participation improving: Growth in work-from-home and fintech-driven employment.

- Green jobs expansion: Renewable energy sector projected to create 10 million jobs by 2030.

Key Takeaways for UPSC Prelims

- Unemployment Rate (FY25): 3.2%.

- Labour Force Participation Rate: 50.4%.

- Prime Minister’s Internship Scheme: 1 crore youth.

- Women in the Workforce: Increasing via fintech and WFH jobs.

- Green Jobs: 10 million by 2030.

India’s employment scenario is improving, supported by skilling programs, digital job creation, and formalization of the workforce, but sectoral shifts and automation-driven changes need continuous adaptation.

Chapter 13: Labour in the AI Era – Crisis or Catalyst?

Current Context (2025)

- AI-driven automation is reshaping global labour markets, with India expected to witness 30-40% job transitions by 2035.

- Generative AI investments surged from $3 billion in 2022 to $25.2 billion in 2023, indicating rapid adoption.

- India’s AI market projected to grow at 25-35% CAGR by 2027, with a shift towards AI-augmented job roles.

Impact of AI on the Labour Market

- Entry-level jobs most at risk, especially in customer service, data entry, and routine-based white-collar jobs.

- High-skill jobs in AI development, data science, and robotics are expected to grow.

- Generative AI could replace up to 57% of occupations in emerging economies, but also create new high-value job categories.

Opportunities & Challenges in AI Adoption

- AI’s impact on India’s workforce depends on skilling and adaptation.

- Automation will augment, not eliminate, many job roles, enhancing worker productivity.

- Digital infrastructure, regulatory frameworks, and ethical AI use are crucial for inclusive AI growth.

Key Government Initiatives

- Skill India Digital Hub (SIDH): AI, blockchain, and cybersecurity-focused training programs.

- FutureSkills Prime Initiative: 1.27 lakh professionals trained in AI-driven job roles.

- PLI Scheme for AI & Robotics: Encouraging indigenous AI startups and innovation.

Key Takeaways for UPSC Prelims

- The AI market in India is projected to grow at 25-35% CAGR by 2027.

- 57% of occupations in emerging economies could be affected by AI.

- Generative AI investment rose from $3B (2022) to $25.2B (2023).

- FutureSkills Prime trained 1.27 lakh professionals in AI.

- Skill India Digital Hub launched for AI skilling.

India’s AI-driven labour market transition presents both challenges and opportunities, requiring strong skilling initiatives, regulatory oversight, and industry-academia collaboration for sustainable workforce transformation.